Disruption is relentless. Having the right strategy to restructure or turn around an organisation can help turn adversity into opportunity.

How EY can help

We work with management and financial stakeholders to use the pace, protection, powers and flexibility available under applicable insolvency law to address the issues threatening a business’ survival. We use contingency planning and insolvency solutions to create restructuring legacies by:

A formal appointment, whether it is a voluntary administration, liquidation or receivership is required to follow processes and time-lines governed by legislation. This section provides background information on the three key formal insolvency pathways as well as information for creditors on all current appointments:

A Voluntary Administration (VA) is a flexible option available to directors and secured creditors to restructure a company. The process is governed by the Corporations Act 2001 Cth (the Act). The overall objective of the process is to administer the affairs of the company in a way that results in a better return to creditors than they would have received if the company had been placed directly into liquidation. Where it is possible to restructure the company or its underlying businesses, the mechanism for achieving this is a Deed of Company Arrangement (DOCA). The VA process is time driven and there is a relatively short timeframe for the potential restructure of the company, unless creditor or Court approval is given to extend the convening period under the VA.

What does a VA do?

After the appointment of the VA, control of the company's business and assets is transferred to the VA and the powers of the company's directors are suspended.

The VA take control of the company and its affairs, investigate the Company's business, property, affairs and financial circumstances to develop a proposal and in the majority of cases concurrently explore the commercial merits of divesting the Company's assets. In doing so, the VA attempts to determine the best solution to the company's problems and compares the possible outcomes of the proposals with the likely outcome in a liquidation.

- issues to be considered in respect of any restructuring strategy include:

- impact on key contracts to enable operations to continue

- legislative or government approvals if required

- creditor support

- asset preservation and security

- timing of implementation and cost of any proposed restructure

- ongoing employee and supplier support

- funding requirements.

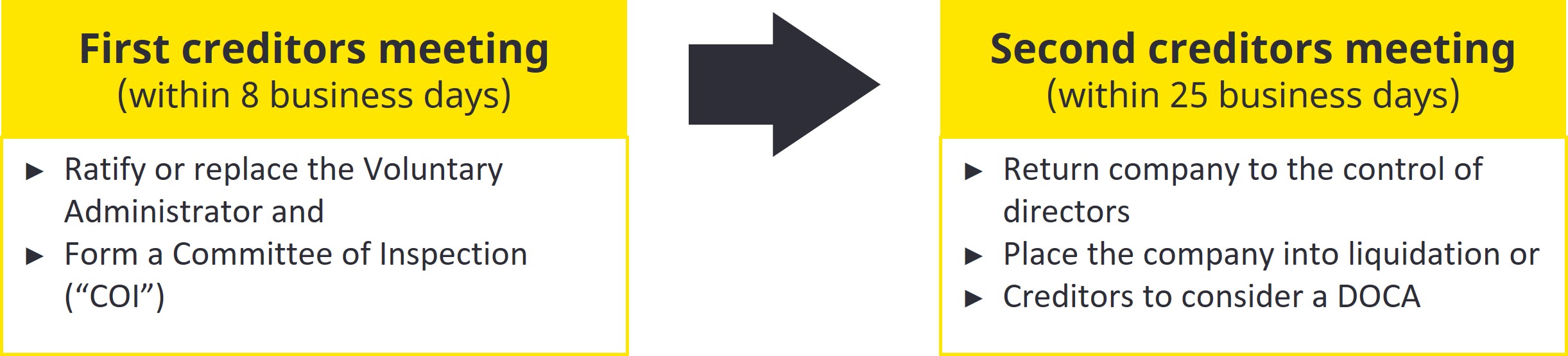

The VA must then convene a meeting of the company's creditors to enable them to consider the VA's recommendations for the future of the company and then decide whether to:

- end the VA and return the company to the directors' control (uncommon)

- approve a DOCA which dictates the terms and conditions of any restructure and/or sale as well as the return to the various classes or stakeholders, or

- wind up the company and appoint a liquidator.

Effect of the appointment

The effect of the appointment of a VA is to provide the company with time within which the stakeholders can determine the company's future. While the company is in VA:

- unsecured creditors cannot begin, continue or enforce their claims against the company without the Administrator's consent or the Court's permission

- owners of property (other than perishable property) used or occupied by the company, or people who lease such property to the company, cannot recover their property

- except in limited circumstances, secured creditors cannot enforce their security over company property

- a Court application to put the company in liquidation cannot be commenced

- a creditor holding a personal guarantee from the company's director or other person cannot act under the personal guarantee without the Court's consent

Liquidation is the orderly winding up of a company’s affairs. It involves realising the company’s assets, cessation or sale of its operations, distributing the proceeds of realisation among its creditors and distributing any surplus among its shareholders. There are five principal forms of liquidation, being:

Provisional Liquidation (“PL”)

PL is an interim procedure aimed at preserving the status quo of a company until a winding up order is made. It differs from other winding up procedures in that it is not concerned with maximising the assets available for distribution among creditors but is simply an interim procedure.

Provisional liquidation is an attractive option where a winding up application has been filed and the parties are:

- Concerned that the assets of the company will disappear before the winding up order is made, and/or

- Believe that it is necessary to shift control of the company away from the directors in the interim

The option of provisional liquidation will therefore be of interest to unsecured creditors since it will act to preserve the assets that creditors may be entitled to once the winding up order has been made.

However, it is also attractive to the company and its directors where there are concerns that further liability will be incurred in the period between the winding up application and the winding up order, as control and liability effectively will shift from the directors to the provisional liquidator.

Creditors Voluntary Liquidation (“CVL”)

A CVL occurs when a company's shareholders determine that it can no longer satisfy its debts and deem it to be insolvent, or likely to become insolvent. A majority of the company's shareholders must resolve to place the company into liquidation. The purpose of a CVL is to convert the company’s assets into a pool of funds from which creditor claims can be met.

The role of a liquidator in a CVL includes:

- Undertaking investigations into the failure of the company and reporting findings to ASIC

- Realising any assets owned by the company

- Reporting findings and dividend prospects to creditors of the company

- Quantifying employee entitlements based on the company’s books and records and verifying same under the Fair Entitlements Guarantee (“FEG”) Scheme

- Pursuing any claims identified (including against directors, related parties or other stakeholders)

- Distributing funds to creditors in the order of priorities set out in subsection 556(1) of the Corporations Act 2001

- Attending to administrative tasks including reporting annually to ASIC.

Simplified Liquidation (“SL”)

The purpose of the SL process is to provide for a more cost effective and streamlined liquidation process for the purpose of winding up the affairs and distributing the property of an eligible company in a CVL.

The intention of the simplified liquidation process is to supplement the ‘one–size-fits-all’ liquidation regime with a regime that has appropriate pathways for less complex liquidations, in particular for incorporated small businesses with less than $1m in liabilities.

By reducing complexity, time and costs in the liquidation process, the simplified liquidation process is intended to ensure greater returns to creditors and employees.

The general requirement for the SL process is that the company must be in CVL before it is eligible to adopt the simplified liquidation process (triggering event). Directors can then make a declaration that the company is eligible to adopt the SL process. Creditors have 10 business days to object to the adoption of the SL process.

Court Liquidation (“CL”)

A CL is a similar process to a CVL, however the appointment follows an application to the Court by creditors, company members or other interested parties to wind up the company due to unpaid debts. In making the winding up Order, the Court will also appoint a liquidator for the purposes of conducting the CL. The applicant creditor (called the “petitioning” creditor), generally nominates the liquidator.

A CL administers a similar process to a CVL, with slightly different reporting obligations. A CL allows for a systematic approach to winding up a company and bringing its affairs to an end. A CL will investigate the company’s failure and report findings to ASIC, similar to the role of a liquidator in a CVL.

Members Voluntary Liquidation (“MVL”)

An MVL is a solvent process by which the assets of a company are distributed to its creditors (if any) and members under the control of a liquidator, who is subject to the legislative requirements of the Corporations Act 2001.

In order to initiate an MVL, directors of the company must sign a Declaration of Solvency, which states that the company is solvent and able to meet all of its debts within 12 months. Surplus assets are distributed to shareholders, following which the liquidator submits documentation with ASIC to finalise the MVL and the company is automatically deregistered by ASIC three months after the conclusion of the liquidation.

Receivership is a form of external administration which may apply to corporations, partnerships and individuals. Corporate receiverships are the most common and are generally associated with financial distress, in circumstances where a secured creditor appoints a receiver to a company which has defaulted under a loan facility or when the assets of a company are under threat because of the company’s financial instability.

The receiver is generally appointed by the secured creditor to recoup its loan through sale of assets subject to its security. In some cases a receiver or receiver and manager can be appointed by the Court pursuant to s1323(1)(h) of the Corporations Act 2001(Cth) (the Act) which provides for the appointment of receivers to the property of an individual as well as a receiver or receiver and manager to the assets of a company in certain circumstances where actions have begun by way an investigation by ASIC, or a prosecution for an offence or civil proceedings have commenced under the Act.

A receivership appointment may encompass all the property of the company or be limited to one or a number of specific items of property. The security interest held by the secured creditor under which the appointment of a receiver is made may comprise:

- A non-circulating security interest over particular assets of the company (e.g. land, plant and equipment), and/or

- A circulating security interest over assets that are used and disposed of in the course of normal trading operations (e.g. debtors, cash and stock).